Portland Real Estate 2026 What We’re Watching and What It Might Mean for Buyers

Every January we get the same question: “So… what’s going to happen this year?” If we had that kind of magic, we’d be on a beach somewhere and not staring at spreadsheets. But we can look at the patterns that drive the Portland market and make some pretty solid guesses.

Here’s what we’re watching as we head into 2026, plus what it could mean for you if you’re planning to buy.

The big national storyline

Most national forecasts are pointing to a calmer year. Not a dramatic swing, more like a slow thaw.

Mortgage rates: Zillow expects rates to stay above 6% in 2026. NAR economists have also discussed the possibility of rates easing toward around 6% if predictions hold.

Home prices: Zillow forecasts modest price growth nationally (they cite about 1.2%).

More movement: Zillow projects existing home sales rising in 2026 versus 2025.

A little more buyer breathing room: Realtor.com expects a “more balanced” market in 2026, leaning slightly more buyer-friendly than 2025, but still with inventory constraints in many places. Media | Move, Inc.

Translation: fewer fireworks, more slow shifts.

What we’re seeing in Portland based on RMLS data

We created charts using the RMLS Portland Metro dataset (2024–2025), here are a few helpful takeaways:

Inventory: Months of inventory averaged about 16% higher in 2025 than 2024. More homes to choose from compared to the year before, even though it still wasn’t “a lot.”

Months of inventory shows how much “breathing room” buyers may have. Lower usually means more competition.

Prices: The typical (median) sale price in 2025 was up about 1% compared to 2024. That’s not a surge, it’s more like steady footing.

Median sale price helps us track the “typical” home price over time.

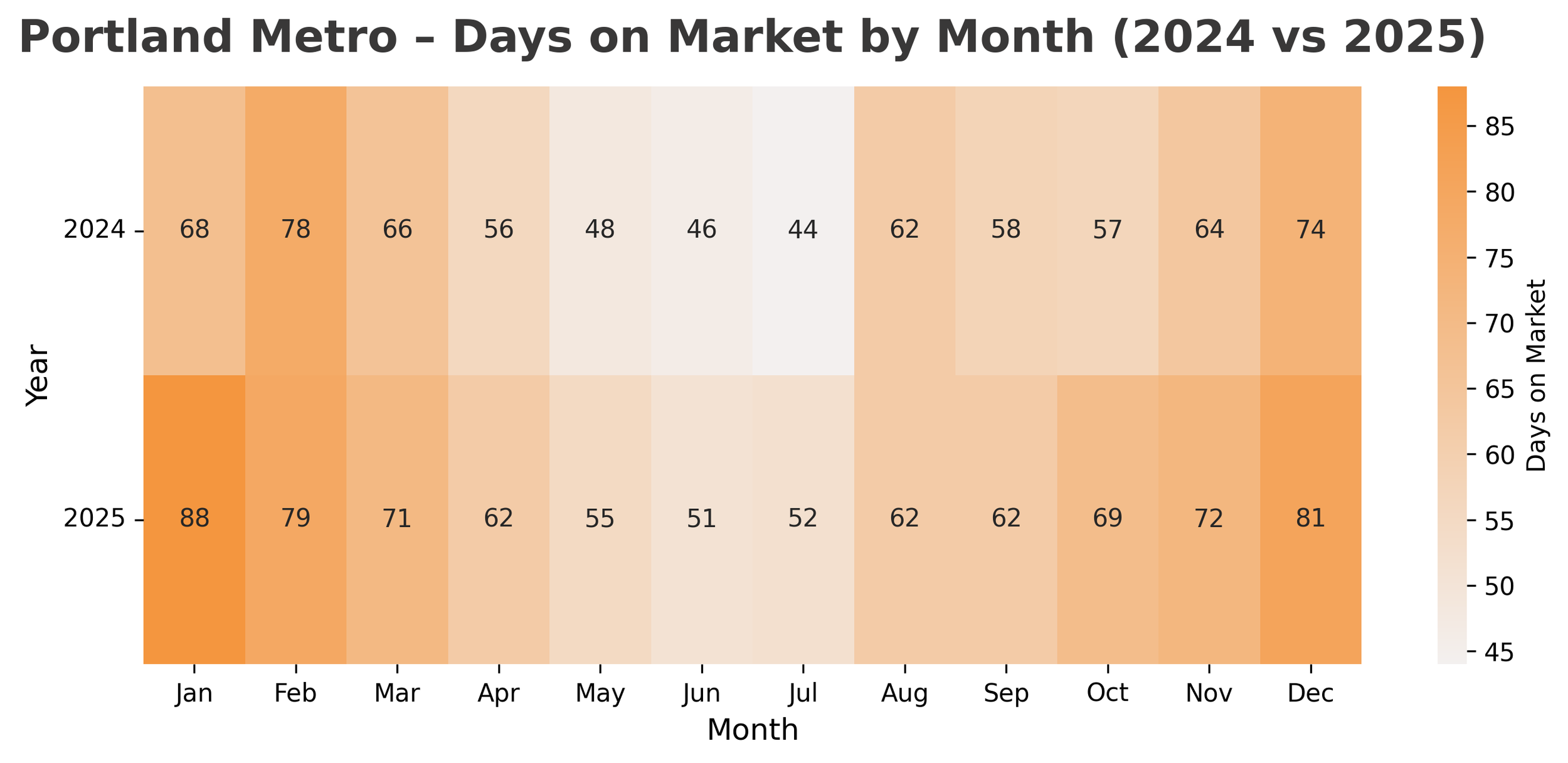

Days on market: Average market time ran about 11% longer in 2025 than 2024. Buyers had a touch more time to think. Sellers still sold, but it was less instant-no-questions-asked.

Portland Oregon’s days on market shows how quickly homes are moving month to month.

New listings vs closed sales: Inventory stayed ahead of demand for much of the year. Buyers had options, and sellers couldn’t rely on speed alone to drive results.

New listings versus closed sales gives a quick sense of supply coming in and how fast it’s getting absorbed.

That combo usually signals a market that’s still competitive, but not as frantic.

What this might mean for buyers in 2026

Here’s the most realistic version.

1) If rates drift down, more buyers jump back in

Even a small rate drop can pull sidelined buyers off the bench. That tends to show up first in spring and early summer.

2) Inventory matters more than headlines

If Portland inventory stays closer to what we saw in 2025 (rather than tightening back up), buyers keep more leverage. The inventory heatmap featured above let’s us track these patterns.

3) The “right” strategy is neighborhood-specific

There really isn’t one single “Portland market.” What we see on the ground is a collection of smaller, very local markets. The right approach in Sellwood can look completely different from what works in Kenton, or Bridlemile.

Our quick take

We’re planning for a 2026 that feels more like “measured” than “wild.” If rates ease, we could see more competition. If inventory holds, buyers get more choices and a bit more negotiating room. Both can be true at the same time.

If you’re buying this year, the real power move is getting prepared early so you can act fast when the right home shows up. Not frantic. Just ready.

Dive into Portland's real estate market with a personal touch from Campbell Salgado Real Estate Group.

Reply and tell us what areas you’re looking in and what your “must-haves” are. We’ll give you a realistic game plan. Reach out to Francisco and Kim for innovative solutions to all your real estate needs by calling or texting us at 503-951-8547.