Evaluate Rental Property Like a Pro with Cap Rate & GRM

How Joe and Kelly Used Two Simple Formulas to Buy Smart in Woodstock

Investing in a multi-unit property can be a great way to build long-term wealth, but success starts with understanding the numbers. Two of the most important are Cap Rate and Gross Rent Multiplier (GRM)—tools that help you see if a property’s income potential really matches the price tag.

Joe and Kelly, longtime Portland homeowners, were ready to buy a small multifamily property that would generate steady cash flow and grow in value over time. When they spotted a charming Craftsman triplex in Woodstock, they loved the idea—but first, they had to be sure the numbers made sense.

Finding the Right Multi-Unit Property

Here’s what they wanted:

Reliable income to cover costs and generate profit.

A strong location with good tenant demand and walkability.

A property with Portland charm, not just another boxy rental.

The triplex checked those boxes, but it was the numbers that sealed the deal.

Breaking Down the Numbers: GRM & Cap Rate

► GRM: The Quick Snapshot

The Gross Rent Multiplier (GRM) shows how many years of rent it would take to equal the purchase price—before expenses.

Formula:

GRM = Property Price ÷ Annual Gross Rent

Joe & Kelly’s Triplex:

$837,000 ÷ $84,000 = 11.29 GRM

What that means:

8–10 GRM: Strong deal, high rent vs. price

11–12 GRM: Fair value, stable long-term play

13+ GRM: Pricier property or slower rent growth

Their 11.29 GRM told them the property was fairly priced with room to grow.

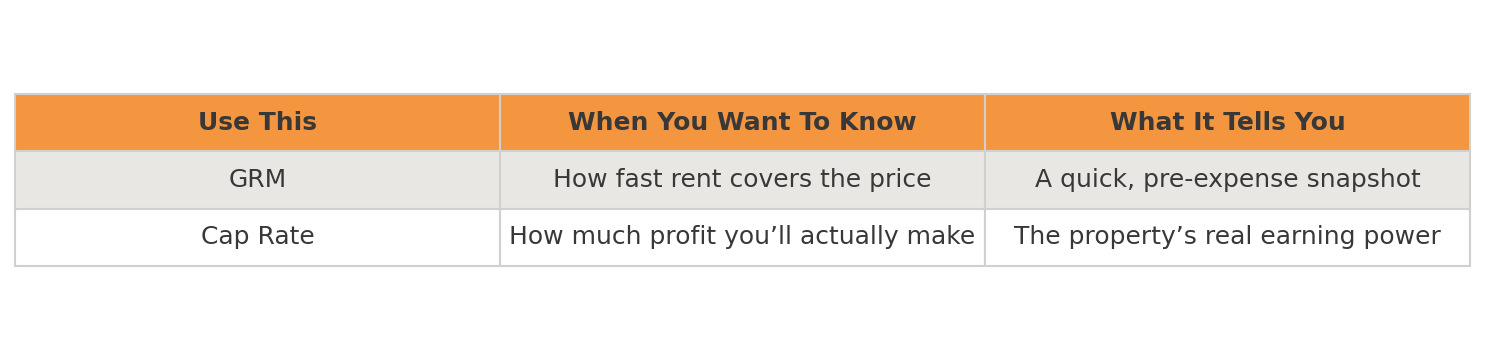

When to Use Cap Rate vs. GRM

GRM is best for quickly comparing properties based on gross rental income. It’s a useful starting point but doesn’t factor in operating expenses.

Cap Rate provides a more detailed view of profitability by accounting for expenses like taxes, maintenance, and management.

In Joe and Kelly’s case, GRM confirmed the property was priced appropriately, while Cap Rate showed it was generating solid cash flow. By looking at both metrics, they ensured they were making a smart investment.

► Cap Rate: The True Return

Cap Rate (short for Capitalization Rate) measures how much income a property produces after expenses—as a percentage of what you paid for it.

Formula:

Cap Rate = (Net Operating Income ÷ Property Value) × 100

Their numbers:

Rental Income: $84,000

Operating Expenses: $24,000

Net Operating Income (NOI): $60,000

Purchase Price: $837,000

Cap Rate = (60,000 ÷ 837,000) × 100 = 7.17%

So What Does 7.17% Actually Mean?

Think of Cap Rate like the annual “interest rate” your property pays you if you bought it in cash.

A 7.17% Cap Rate means that, before financing, the property would earn about $7,170 for every $100,000 invested in one year.

Here’s how to interpret it:

Higher Cap Rate (7–9%) = Stronger cash flow, often in up-and-coming areas or older buildings.

Lower Cap Rate (4–6%) = Lower cash flow but often more stability, newer buildings, or top-tier locations.

So when Joe and Kelly saw 7.17%, it told them they’d get a healthy return now while still benefiting from Woodstock’s ongoing appreciation.

If GRM is about how long it takes to pay off the property, Cap Rate is about how much your money earns each year.

When to Use Each Metric

Before They Closed the Deal

Numbers mattered, but so did due diligence. Joe and Kelly also:

Verified local rents and demand for triplex units in Woodstock.

Double-checked expenses like property taxes and maintenance.

Reviewed future development plans nearby.

Noted the basement’s potential for added income later.

Everything lined up, and they secured a property that earns strong income now and has room to appreciate.

Why This Property Worked

7.17% Cap Rate — strong for Portland’s multifamily market.

11.29 GRM — fair price relative to rent.

Appreciation potential — Woodstock continues to attract buyers and renters.

Classic Portland charm — keeps vacancy low and tenants happy.

Thinking About Buying a Multi-Unit Property in Portland?

Whether you’re analyzing your first duplex or your fifth triplex, the key is understanding how to measure value beyond the listing price. We help investors compare properties, calculate returns, and identify the right mix of stability and cash flow.

If you’d like to see what today’s numbers look like for multifamily opportunities in Portland, reach out anytime. Want to learn more about rental laws and landlord resources in Oregon? These are two great places to start.

At Campbell Salgado Real Estate Group, we believe smart investing starts with understanding the numbers and market trends.

With deep experience in Portland’s real estate landscape, we guide our clients through every step of the buying process—whether you’re purchasing your first home or expanding your rental portfolio. We take pride in helping investors find properties that balance cash flow, appreciation, and long-term value. If you're thinking about buying an investment property in Portland, let's talk. Call or text us at 503-951-8547 to connect today!