What Every Buyer Should Know About Property Taxes Portland and the 3% Cap

We often have people tell us they don’t want to buy in Portland because of the “high property taxes.”

And while it’s true that Portland’s tax rates are a bit higher than some suburbs, the reality is far more nuanced. Property taxes here can vary dramatically from one neighborhood to the next — sometimes by thousands of dollars a year.

So before ruling out Portland, it’s worth understanding how Oregon’s property tax system actually works, why the discrepancies exist, and why that $750,000 home in Lents or Boise might have a smaller tax bill than a similar one in Laurelhurst or Eastmoreland.

How Oregon Property Taxes Work

Oregon’s property tax system is the same across the state, but its effects are especially visible in Portland.

In 1997, voters passed Measure 50, which capped how much a property’s assessed value—the number taxes are based on—can increase each year. The limit? 3% annually.

That 3% cap applies to assessed value, not to the home’s current market value. So even if your home’s market value doubles, your taxable value only goes up gradually unless you remodel, add on, or build something new.

Your annual tax bill is calculated as:

Assessed Value × Local Tax Rate = Property Tax Bill

The “local tax rate” part varies by area, since every city, school district, and county bond adds its own layer. That’s why Portland’s overall rate is usually higher than neighboring suburbs like Milwaukie or Gresham.

Oregon’s Property Tax Calendar

If you’ve ever wondered how Oregon’s property tax calendar actually works, here’s a quick breakdown. Property taxes are assessed once a year, but the timing can be confusing if you’re new to homeownership here.

In Oregon, everything starts with the assessment date of January 1, when the county assessor determines your property’s value for that tax year. From there, the billing and payment schedule follows a pretty steady rhythm:

January 1 – Property value is assessed.

July 1 – The new tax year officially begins.

Mid-October – Tax statements are mailed out by your county.

November 15 – First payment due (or pay in full by this date to get a 3% discount).

February 15 – Second installment due if you’re paying in thirds.

May 15 – Final installment due.

So, while your property value is determined at the start of the calendar year, your payments actually stretch across the following fiscal year. It’s one of those Oregon quirks that makes sense once you’ve lived through a cycle or two—but if you’re budgeting for your first year of ownership, this timing is definitely something to keep in mind.

Why Taxes Differ So Much Between Portland Neighborhoods

When Measure 50 passed, Portland was in the middle of a citywide reassessment — but the work wasn’t finished before the new law took effect. As a result, some neighborhoods were locked in at much lower “base” values than others.

Back in the mid-’90s, areas like Boise, Kenton, and Lents were considered less desirable and had much lower property values. Established neighborhoods like Eastmoreland, Laurelhurst, and Alameda were already more expensive—and those higher values became their frozen starting point.

Fast forward 25 years, and many of those undervalued neighborhoods have transformed. Property values skyrocketed, but taxes didn’t follow at the same pace because of the 3% cap.

The result is a patchwork of tax bills across the city that often don’t align with what homes are worth today.

Real Examples: Same City, Very Different Taxes

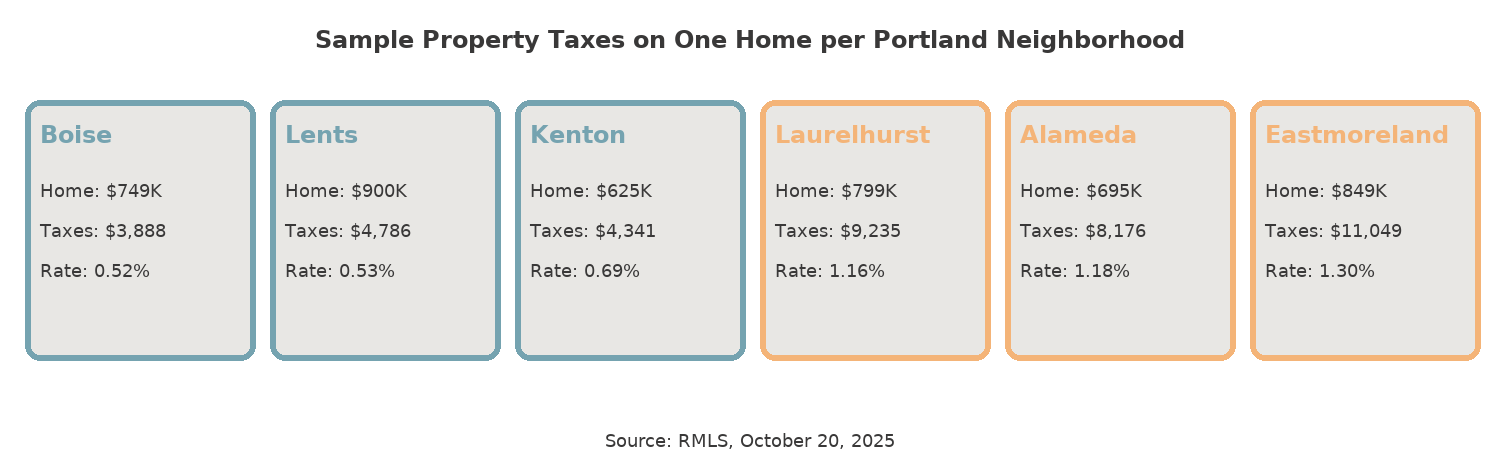

Here’s a comparison from six active listings this fall, showing just how much property taxes can vary from one Portland neighborhood to another:

The History Behind It (and the Uncomfortable Truth About Portland)

Many of the neighborhoods now benefiting from low assessed values were historically redlined, systematically excluded from loans and investment because of the race or ethnicity of their residents. When Measure 50 froze assessments in 1997, those areas were still undervalued due to decades of disinvestment and discriminatory policies.

As these neighborhoods—especially in North and Northeast Portland—began to attract redevelopment and new buyers gentrified these areas, property values surged. But the capped assessment structure meant the taxable values stayed artificially low, even as the market changed dramatically.

This created a new inequity: homes in historically marginalized neighborhoods now carry some of the lowest property tax burdens in the city, while long-established, higher-value areas shoulder a greater share.

It’s one of Portland’s more uncomfortable truths—our property tax system still reflects the city’s history of redlining and gentrification, even decades later.

What Are “Abatement Neighborhoods”?

You might also hear locals mention abatement neighborhoods. These are areas where the city offered temporary property tax abatements to encourage development or rehabilitation—often in parts of North, Northeast, and Inner East Portland.

Abatements are still in use today through programs like the City of Portland’s Multiple-Unit Limited Tax Exemption (MULTE →) and the Homebuyer Opportunity Limited Tax Exemption (HOLTE →).

These programs are designed to promote affordable housing and redevelopment in targeted areas. During the abatement period (typically 10–15 years), property owners pay little to no taxes on improvements. After the exemption expires, the home is reassessed and fully taxed at its current market value.

You can learn more about active abatement programs on the City of Portland’s Housing Bureau website.

New Construction and Remodels: The Exceptions to the 3% Rule

If you’re buying a new home, don’t be fooled by a low first-year tax bill. Counties often base initial taxes on the land value only until the structure is fully assessed. That means your $1,800 bill can jump to $8,000 or more once the county updates it.

The same goes for major remodels or additions. Significant improvements—typically $80,000 or more in work, though it varies by county—can trigger reassessment. Only the “new” portion is taxed at full value, but that’s often enough to lift your total bill noticeably.

MAV vs. RMV — Two Key Numbers

If you look at your property tax statement, you’ll see two terms:

RMV (Real Market Value): What the county believes your home could sell for today.

MAV (Maximum Assessed Value): The highest taxable value allowed under the 3% growth cap.

Your actual Assessed Value (AV) is whichever of the two is lower.

Across Portland, most homes are taxed on an AV that’s only 40–50% of their RMV. That’s why two similarly priced homes can have dramatically different tax bills depending on when their assessed value was set.

How Portland Compares to Its Suburbs

The same property tax laws apply statewide, but total rates differ depending on local levies and bonds.

Here’s a rough comparison:

Portland (Multnomah County): 1.1–1.3% effective rate

Milwaukie (Clackamas County): ~0.9–1.0%

Oregon City: ~0.95%

Gresham / Troutdale: ~1.0–1.1%

Vancouver, WA: No Oregon income tax—but property taxes are higher, around 1.2–1.3%

So while Portland’s structure is capped just like the rest of Oregon, the number of local levies tends to push the total a little higher.

Key Takeaways for Buyers

✔︎ Oregon’s 3% cap keeps taxes predictable but uneven.

✔︎ Older homes often have lower taxes than their current market value suggests.

✔︎ New construction starts low, then jumps once fully assessed.

✔︎ Major remodels can trigger reassessment.

✔︎ Portland’s tax variations reflect both timing and history—frozen values, redlining, and gentrification have left a lasting imprint.

When Your Property Tax Bill Doesn’t Add Up

Sometimes a property tax statement shows up and you can’t help but wonder… how did they come up with that number? Maybe you’ve recently bought a home or permitted some remodelling, and the new market activity triggered a reassessment. Or maybe you spotted something on your statement that just doesn’t compute — an outdated square footage, a missed exemption, or untaxed improvements that suddenly appeared.

Whatever the reason, it’s not uncommon for homeowners to discover their property has been over-assessed, which means you could be paying more than your fair share.

That’s why we were especially glad to attend a recent property tax workshop with Steve Anderson, better known as the Property Tax Avenger. Steve’s team specializes in helping homeowners challenge inaccurate assessments, and they offer a free evaluation to see if your home qualifies for an appeal. As an appraiser, he knows how to argue for the real value of improvements, not just the contractor’s invoice — and those numbers can differ quite a bit.

They handle everything from filing the appeal to representing you before the County Assessment Appeals Board, and there are no upfront costs. Their fee only applies if they successfully win your case and you receive a refund — meaning there’s really nothing to lose.

If your property value or tax bill seems off, it might be worth reaching out to Steve’s team to see if a reassessment could save you some money.

Get your free property tax dispute evaluation →

Final Thoughts

When people say Portland’s property taxes are “too high,” we always say, “It depends.” Two homes at the same price can have very different tax bills depending on when they were built, who owned them, and what’s changed over the years.

If you’re comparing neighborhoods or deciding between Portland and the suburbs, understanding these nuances can help you budget more accurately and avoid surprises when that first tax bill arrives.

We’re happy to walk you through what to expect for any property you’re considering—and share a few examples of how timing and history shape the numbers behind the tax bill.

Ready to Talk About Buying in Portland?

We love helping buyers make sense of Portland’s housing market — quirks and all. From property taxes to neighborhood vibes, we’ll help you see the full picture so you can buy with confidence (and no surprises when that first tax bill arrives).

If you’re thinking about making a move, let’s chat. We’re Kim and Francisco, a husband-and-wife real estate team who know Portland block by block — from the quiet corners of Eastmoreland to the creative streets of Boise.

Disclaimer:

This information is provided for general educational purposes and should not be construed as legal, financial, or tax advice. Property tax laws and regulations can vary and change over time. Homeowners are encouraged to consult with a qualified tax professional, attorney, or local assessor’s office for guidance specific to their situation.